As a leading international supplier in the bearing industry, DFL NSAR closely monitors emerging markets to provide customers with the latest insights and high-performance bearing solutions.

Driven by growing demand, the ball bearing market in Latin America and the Caribbean is expected to grow in the coming years. The region is expected to grow at a CAGR of +0.7% in terms of volume and +1.2% in terms of value between 2024 and 2035, reaching impressive levels by the end of the forecast period.

Driven by the growing demand for ball bearings in Latin America and the Caribbean, the market is expected to continue its upward trend over the next decade. Market growth is expected to slow, growing at a CAGR of +0.7% between 2024 and 2035, reaching a market capacity of 132,000 tons by the end of 2035.

In terms of value, the market is expected to grow at a CAGR of +1.2% between 2024 and 2035, with the market value expected to reach $1.8 billion by the end of 2035 (at nominal wholesale prices).

Ball bearing consumption in Latin America and the Caribbean

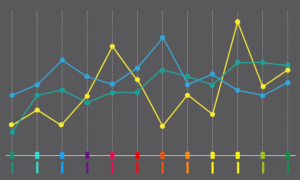

Ball bearing consumption in Latin America and the Caribbean surges to 122,000 tons in 2024, up 18% from the previous year. Ball bearing consumption in the region grew at an average annual rate of +2.1% between 2013 and 2024; the trend remained stable with only minor fluctuations throughout the analysis period. Ball bearing consumption in the region peaked at 131,000 tons in 2022; however, consumption in the region declined slightly between 2023 and 2024.

The Latin America and the Caribbean ball bearing market surges to $1.6 billion in 2024, up 17% from the previous year. The data reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailer margins, which are included in the final consumer price). Between 2013 and 2024, the market value grew at an average annual rate of +1.4%; the trend remained relatively stable, but with more pronounced fluctuations in some years. During the reporting period, the market reached a peak of $1.9 billion in 2019; however, from 2020 to 2024, the consumption growth momentum failed to recover.

In 2024, overseas purchases ofrodamientos de bolasgrew for the first time since 2021 by 4.7% to 103,000 tons, ending a two-year downward trend. Between 2013 and 2024, total imports showed significant growth: the average annual growth rate of imports was +2.1% over the past 11 years. However, the trend pattern shows some notable fluctuations throughout the analyzed period. According to the 2024 data, imports fell by -9.4% compared to the 2021 index. The most significant growth was in 2021, when imports increased by 61% to a peak of 114,000 tons. Import volume growth fails to regain momentum from 2022 to 2024.

In terms of value, ball bearing imports total $1.2 billion in 2024. From 2013 to 2024, the average annual growth rate of total imports was +1.1%; however, the trend pattern remained relatively stable, with slight fluctuations throughout the analysis period. The most significant growth rate was in 2021, with an increase of 35%. Imports peaked at $1.3 billion in 2022; however, imports remained at a low level from 2023 to 2024.

Mexico (45,000 tons) and Brazil (35,000 tons) dominated the import structure, accounting for a combined 77% of total imports. They were followed by Colombia (47,000 tons), accounting for 4.6% of total imports. The next importing countries – Argentina (4,000 tons), Bolivia (21,000 tons), Peru (21,000 tons) and Chile (17,000 tons) – together accounted for 9.5% of total imports.

The largest increase between 2013 and 2024 is in Bolivia (CAGR of +11.6%), while purchases by other leading countries grow at a more modest pace.

In value terms, Mexico ($606 million), Brazil ($336 million) and Colombia ($55 million) are the top importers in 2024, together accounting for 80% of total imports. Argentina, Chile, Peru and Bolivia lag slightly behind in value, together accounting for 10%.

In terms of the major importers during the review period, Bolivia has the highest growth in value, with a CAGR of +3.3%, while purchases by other major importers grow at a more modest pace.

NSAR produces high qualityRodamientos rígidos de bolasyRodamientos de bolas con chumacera, contact our technical experts for the latest quotes.

Copyright © Rodamientos NSAR. Reservados todos los derechos.política de privacidad